Agricultural Microbials Market Size and Forecast

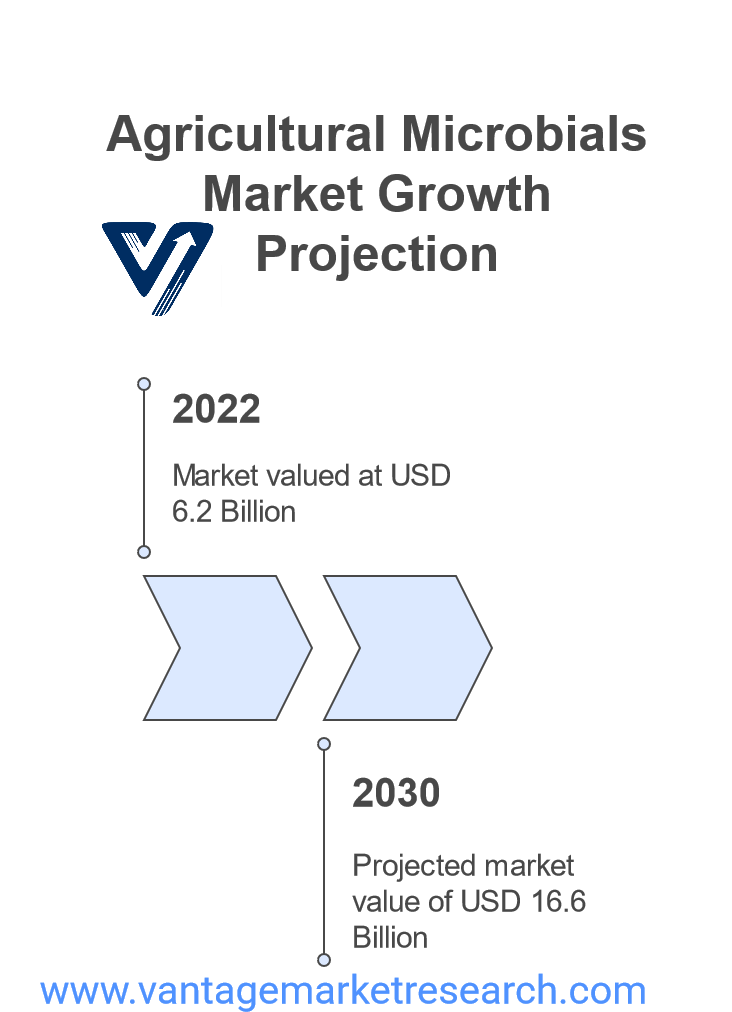

According to analysts at Vantage Market Research, the Global Agricultural Microbials Market, valued at USD 6.2 billion in 2022, is expected to grow significantly at a compound annual growth rate (CAGR) of 15.20% from 2023 to 2030, reaching USD 16.6 billion by 2030. This impressive growth is attributed to the increasing demand for eco-friendly and sustainable farming solutions, especially in North America and Europe, where agricultural practices are increasingly embracing microbial products. North America, in particular, accounts for more than half of all biopesticides produced globally, underlining the region’s significant role in shaping the market. The use of agricultural microbials has witnessed a notable surge, driven by a growing preference for organic farming methods and a collective effort to reduce the environmental impact of conventional agricultural practices.

Agricultural microbials, such as biopesticides, biofertilizers, and biostimulants, are gaining traction due to their effectiveness in promoting sustainable agriculture. These products offer natural solutions to soil health, crop protection, and pest control while minimizing harmful chemical usage. They help address the growing concerns over the environmental degradation caused by traditional agricultural practices, such as the overuse of synthetic pesticides and fertilizers. Moreover, the increasing adoption of organic agriculture—fueled by consumer demand for residue-free food products—is further driving the market for agricultural microbials.

As developing economies like India and China are recognizing the importance of sustainable agriculture, agricultural microbials are likely to see a rise in adoption, particularly as these regions shift toward organic farming. In these markets, however, the challenge lies in improving the application techniques and scaling up production to meet the demands of large-scale agriculture. The global agricultural microbial market is expected to thrive due to the growing need for agricultural sustainability, pest resistance management, and reduced residue levels in food products.

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.vantagemarketresearch.com/agricultural-microbials-market-1064/request-sample

Market Dynamics

The growth of the agricultural microbials market is influenced by several key factors. Among the most significant drivers is the increasing emphasis on sustainable agricultural practices, which are aligned with the rising consumer demand for organic food products. Governments worldwide are incentivizing the use of biopesticides, biofertilizers, and other microbial solutions to reduce the reliance on synthetic chemicals and address environmental concerns. For instance, the European Union’s Farm to Fork Strategy, which aims to reduce pesticide usage by 50% and expand organic farming areas to 25% by 2030, has created a favorable environment for the adoption of agricultural microbials. Additionally, global initiatives aimed at reducing the harmful impacts of pesticides, such as the USD 379 million program launched by the Global Environment Facility, support the use of microbial technologies in agriculture.

Despite the promising outlook, the market also faces challenges. One major restraint is the shorter shelf life and complex storage requirements of agricultural microbial products. These products, being derived from living organisms, require optimal conditions to maintain their potency. The shelf life of many microbial products is limited, and improper storage can significantly reduce their effectiveness. This limitation is particularly problematic in regions lacking efficient cold chain logistics. Furthermore, environmental factors, such as soil type, temperature, and moisture levels, can affect the performance of microbial products, making them less reliable than traditional chemical alternatives.

Opportunities in the market include government subsidies and support programs that encourage the adoption of sustainable practices. These initiatives lower financial barriers for farmers and agribusinesses, facilitating the widespread use of agricultural microbials. Moreover, the push for organic farming and the gradual phase-out of harmful synthetic chemicals presents a significant opportunity for the market to expand further.

However, the agricultural microbial market also faces challenges in terms of product consistency and performance. Microbial products are highly sensitive to environmental factors, and their effectiveness can vary greatly depending on the conditions under which they are applied. Inconsistent field performance is a concern, as microorganisms may not always establish themselves effectively or may be outcompeted by indigenous soil microbes. This variability can limit the widespread adoption of microbial products, as farmers may not see the desired results.

Segmentation Insights

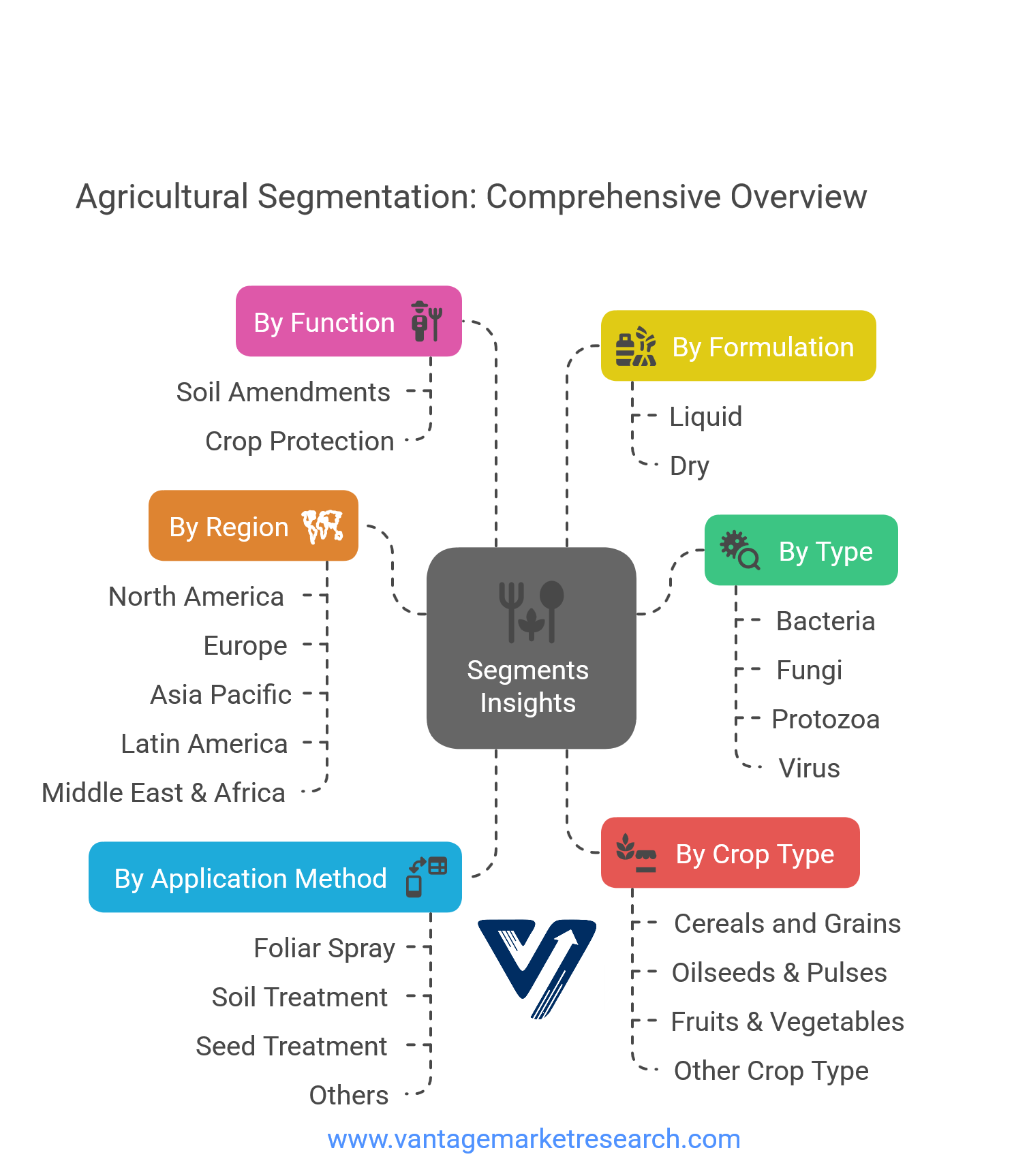

The agricultural microbials market can be segmented based on various factors, including type, function, formulation, application method, crop type, and region.

By Type:

-

- Bacteria: Bacteria are the most commonly used microorganisms in agricultural microbials, especially in biopesticides and biofertilizers.

- Fungi: Fungal-based products are primarily used for pest control and promoting plant growth.

- Protozoa and Viruses: These are less commonly used but are gaining attention for specific pest control applications.

By Function:

-

- Soil Amendments: Microbial solutions used to enhance soil quality and promote plant growth.

- Crop Protection: Biopesticides and biofungicides are used to protect crops from pests and diseases.

By Formulation:

-

- Liquid: Widely used for easier application in large-scale farming.

- Dry: Typically used for soil amendments and certain biopesticides.

By Application Method:

-

- Foliar Spray: Applied directly to the leaves for pest control.

- Soil Treatment: Used to improve soil health and promote growth.

- Seed Treatment: Applied to seeds before planting to protect against diseases.

By Crop Type:

-

- Cereals and Grains: A major segment due to the global demand for staple crops.

- Oilseeds & Pulses: A growing segment, especially in regions like Asia Pacific.

- Fruits & Vegetables: Organic farming practices in this segment are driving demand.

- Other Crop Types: Including turf, ornamentals, plantation crops, and silage & forage crops.

By Region:

-

- North America: Dominates the market, with significant contributions from the U.S. and Canada.

- Europe: Expected to register the highest growth due to stringent regulations and an increasing focus on sustainability.

- Asia Pacific: This is a growing market due to the increasing adoption of organic farming practices in countries like India and China.

Take Action Now: Secure Your Position in the Global Agricultural Microbials Industry Today – Purchase Now.

Industry Ecosystem Insights

Several established players are active in the global agricultural microbial market, including BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), Corteva (US), and FMC Corporation. These companies lead the market with a diversified product portfolio, significant R&D capabilities, and a global presence.

The crop protection segment holds the largest share of the market, driven by the demand for sustainable and effective pest control solutions. Biopesticides, biofungicides, and bioherbicides are gaining traction due to their eco-friendly nature and compatibility with integrated pest management (IPM) practices.

Soil treatment applications, including biofertilizers, biostimulants, and bioremediation agents, are also witnessing significant growth. These products are increasingly sought after for their ability to enhance soil health, improve nutrient availability, and promote long-term agricultural productivity. North America and Europe are leading regions in adopting microbial soil treatments due to their focus on regenerative farming practices.

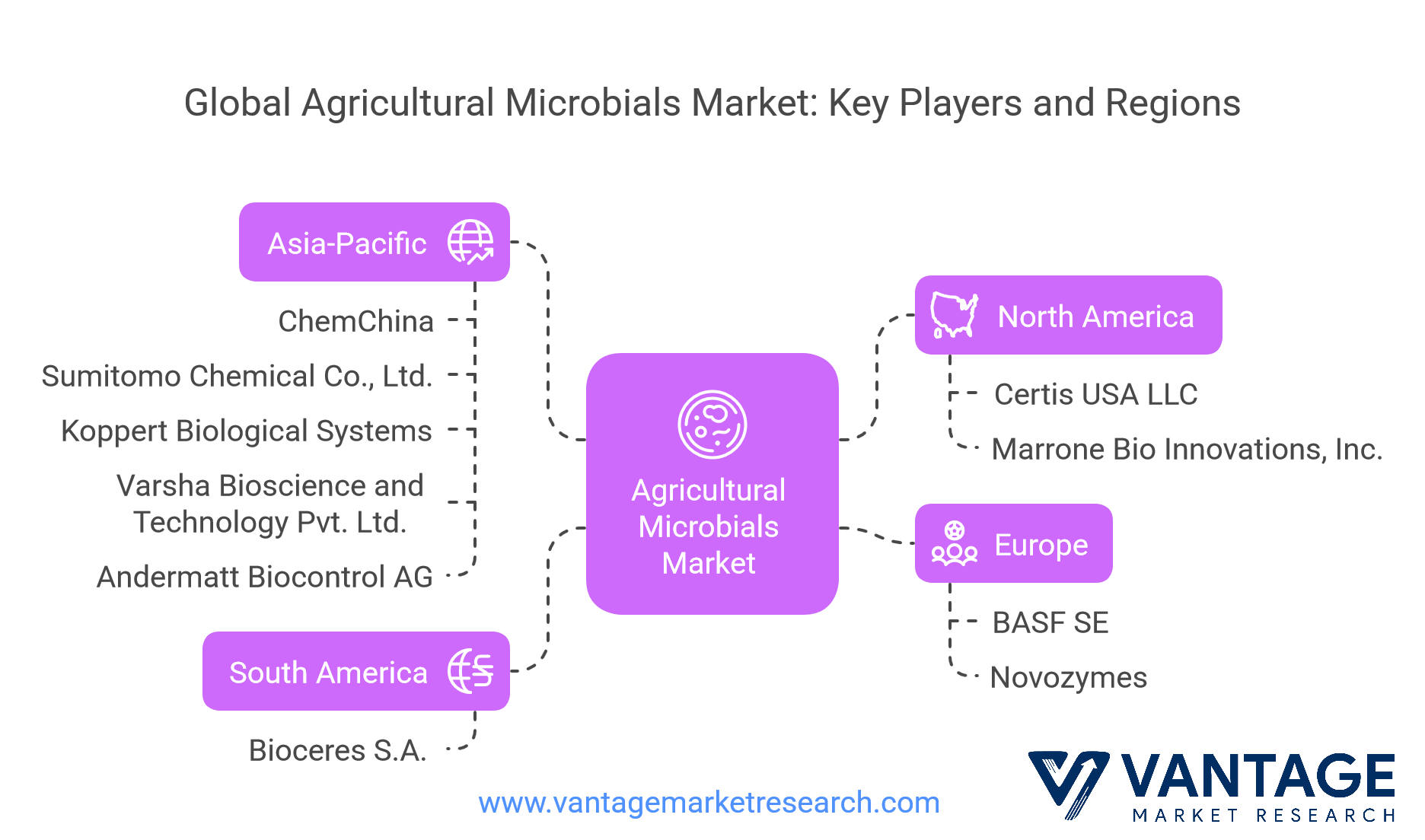

Competitive Landscape

The agricultural microbials market is highly competitive, with a wide range of key players competing for market share. Some of the major players in this market include Certis USA LLC (U.S.), ChemChina (China), Marrone Bio Innovations (U.S.), Koppert Biological Systems (Netherlands), Varsha Bioscience and Technology Pvt. Ltd. (India), and Andermatt Biocontrol AG (Switzerland). These companies are focused on R&D efforts to create advanced microbial solutions tailored to specific agricultural needs.

The growing demand for sustainable agricultural practices has led to an increase in partnerships, acquisitions, and collaborations among key players. For example, in December 2024, Koppert and Amoéba partnered to introduce AXPERA, a biofungicide targeting fungal diseases. Similarly, in May 2024, FMC Corporation and Optibrium signed an agreement to explore new biopesticide solutions using machine learning and AI.

For the Agricultural Microbials Market Research Report and updates, view the full report now!

Top 10 Companies in Agricultural Microbials Industry

- Certis USA LLC (U.S.)

- ChemChina (China)

- Marrone Bio Innovations Inc. (U.S.)

- Koppert Biological Systems (Netherlands)

- Varsha Bioscience and Technology Pvt. Ltd. (India)

- Andermatt Biocontrol AG (Switzerland)

- BASF SE (Germany)

- Sumitomo Chemical Co. Ltd. (Japan)

- Novozymes (Denmark)

- Bioceres S.A. (Argentina)

Recent Developments in the Agricultural Microbials Market (2024-2025)

The agricultural microbial market has witnessed notable developments in recent years, signaling a transformative shift toward more sustainable and innovative crop protection solutions. These developments are not only changing how farmers approach pest control and soil management but also indicating how the sector is evolving to meet global agricultural demands while minimizing environmental impact. From groundbreaking partnerships to significant investments, here are some of the key recent developments that are shaping the future of the agricultural microbials market.

In December 2024, Koppert Biological Systems teamed up with Amoéba, a greentech company specializing in microbiological solutions, to introduce a pioneering biofungicide called AXPERA. This product leverages Amoéba’s patented amoeba lysate technology, which effectively combats fungal diseases in crops. The partnership underscores the growing interest in natural solutions for managing plant diseases and highlights how innovative microbial products are gaining traction as an alternative to traditional chemical pesticides. AXPERA represents a significant breakthrough, providing sustainable and eco-friendly protection for crops, aligning with the global push towards reducing the environmental footprint of agricultural practices. The collaboration between Koppert and Amoéba showcases how the agricultural microbial market is being driven by advanced biological solutions that promise enhanced efficacy and minimal environmental impact.

Similarly, Bioceres Crop Solutions Corp. made headlines in May 2024 with an announcement regarding the approval of three new bioinsecticidal and bio-nematocidal products by Brazil’s Ministry of Agriculture and Livestock (MAPA). These products are derived from the company’s proprietary Burkholderia platform, which uses inactivated cells to offer a highly effective and eco-friendly approach to controlling insect pests and nematodes in agricultural systems. The approval of these new solutions further strengthens Bioceres’ position in the global agricultural microbial market, particularly in Latin America, where there is a growing demand for biological pest control methods. This development is indicative of the increasing regulatory acceptance of biocontrol products and the expanding role of biological products in managing pests in various agricultural sectors.

In the realm of technology and innovation, FMC Corporation and Optibrium entered into an agreement in May 2024 to fast-track the discovery of novel crop protection technologies, including biopesticides. The collaboration involves the use of machine learning (ML) and artificial intelligence (AI) to accelerate the development of new microbial-based solutions for pest management. The integration of AI and ML into the research and development process holds immense potential for the agricultural microbials market, allowing for the creation of more precise, tailored solutions for specific pest and pathogen challenges. This partnership highlights the increasing role of cutting-edge technologies in improving the performance and efficiency of agricultural microbial products, ensuring that they are not only effective but also scalable and cost-efficient for farmers.

Another significant milestone occurred in April 2024 when Bayer entered into a partnership with AlphaBio Control, a UK-based company specializing in biological insecticides. This collaboration will result in the launch of a new biological insecticide designed for use in arable crops such as oilseed, rapeseed, and cereals. The new insecticide marks a major step for Bayer in expanding its sustainable crop protection portfolio, aligning with the growing demand for environmentally friendly alternatives to synthetic chemicals. Bayer’s investment in biological insecticides reflects the company’s strategic shift toward sustainable farming practices and its commitment to providing farmers with innovative solutions that meet both economic and environmental challenges.

Lastly, BASF, a global leader in agricultural solutions, made a substantial investment in March 2024, with plans to build a new fermentation plant at its Ludwigshafen site. This plant, slated to begin operations in the second half of 2025, will focus on the production of biological and biotechnology-based crop protection products, including microbial fungicides and seed treatments. This investment signals BASF’s long-term commitment to the growth of the agricultural microbial sector and its focus on providing sustainable solutions for crop protection. By ramping up production capabilities for microbial-based solutions, BASF aims to meet the increasing demand for natural alternatives to chemical pesticides and enhance the sustainability of farming practices worldwide.

These recent developments underscore the rapid evolution of the agricultural microbial market as key players embrace new technologies, regulatory changes, and consumer demands for more sustainable practices. The collaborations, investments, and product innovations announced in 2024 highlight a growing recognition of the importance of microbial solutions in the global effort to reduce the environmental impact of agriculture while improving crop productivity. As we look ahead to the next decade, it is clear that the agricultural microbials market will continue to play a pivotal role in shaping the future of global food production.

FAQ.

- What are the key factors driving the growth of the agricultural microbials market from 2025 to 2035?

- How will government policies and subsidies impact the adoption of agricultural microbials in the next decade?

- What technological advancements in microbial formulations are expected to shape the agricultural microbials market by 2035?

- Which regions are expected to dominate the agricultural microbials market from 2025 to 2035, and why?

- How will the demand for organic farming influence the agricultural microbial market in the coming years?

- What are the major challenges that agricultural microbial products will face in terms of storage and shelf life by 2035?

- How are advancements in biotechnology expected to enhance the efficacy and performance of agricultural microbials?

- What role will consumer preferences for environmentally friendly products play in the market for agricultural microbials in 2025-2035?

- Which crop types will experience the highest demand for agricultural microbial solutions in the next decade?

- How are major players in the agricultural microbials industry collaborating with research institutions and governments to promote sustainable agriculture?

![[Market Research Reports] – Research Google News Blog | VMR.Biz](https://www.vmr.biz/wp-content/uploads/2022/12/logo-removebg-preview.png)