Biorationals Market Size and Forecast

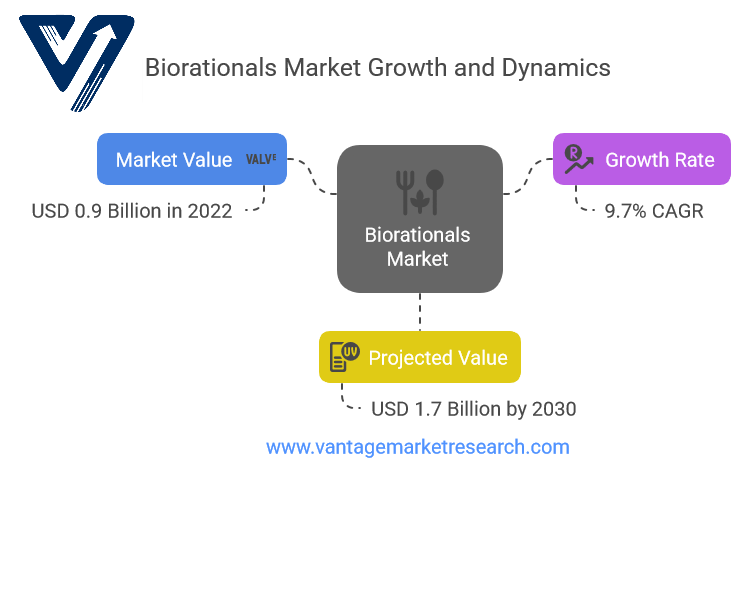

The global Biorationals Market is poised for robust growth over the next decade, reflecting a significant paradigm shift in agricultural practices worldwide. Valued at USD 0.9 billion in 2022, the market is projected to expand to USD 1.7 billion by 2030, growing at a CAGR of 9.7% between 2023 and 2030. This surge can be attributed to increased awareness regarding the adverse impacts of synthetic pesticides on environmental and human health, alongside the expanding role of sustainable farming solutions.

Biorationals are a class of pesticides and insecticides derived from natural or biological origins. Unlike their synthetic counterparts, biorationals present low toxicity and minimal environmental persistence and are often selective in targeting pests, thereby preserving beneficial soil microorganisms and pollinators. Their use is increasingly being adopted across agricultural sectors as an essential component of Integrated Pest Management (IPM) strategies aimed at reducing the ecological footprint of food production.

The increasing incidence of pest and insect resistance to synthetic chemicals has further accelerated the transition toward natural alternatives. Biorationals such as pheromones and plant-based extracts are essential in this fight, helping mitigate crop losses, enhance yields, and promote food security.

Emerging economies in Asia Pacific and Latin America are particularly showing rapid uptake, driven by rising food demand, expanding agricultural acreage, and government support for sustainable farming techniques. Moreover, heightened consumer awareness in developed markets such as the U.S. and Europe about chemical residues in food drives demand for clean-label produce, thus boosting the adoption of biorational solutions.

Notably, the COVID-19 pandemic highlighted vulnerabilities in global food supply chains, which, coupled with growing climate concerns, has emphasized the importance of resilient and eco-friendly agricultural inputs. Research and innovation in bio-based crop protection, increased regulatory backing for green alternatives, and investments from major agri-businesses have catalyzed market momentum.

With agricultural producers facing increasing pressure to comply with safety and sustainability mandates, biorationals present an effective pathway to meet productivity goals while aligning with regulatory and consumer expectations. As biotechnological advancements improve the efficacy and spectrum of biorational solutions, the market is well-positioned for sustained growth through 2035.

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.vantagemarketresearch.com/biorationals-market-2283/request-sample

Product Insights

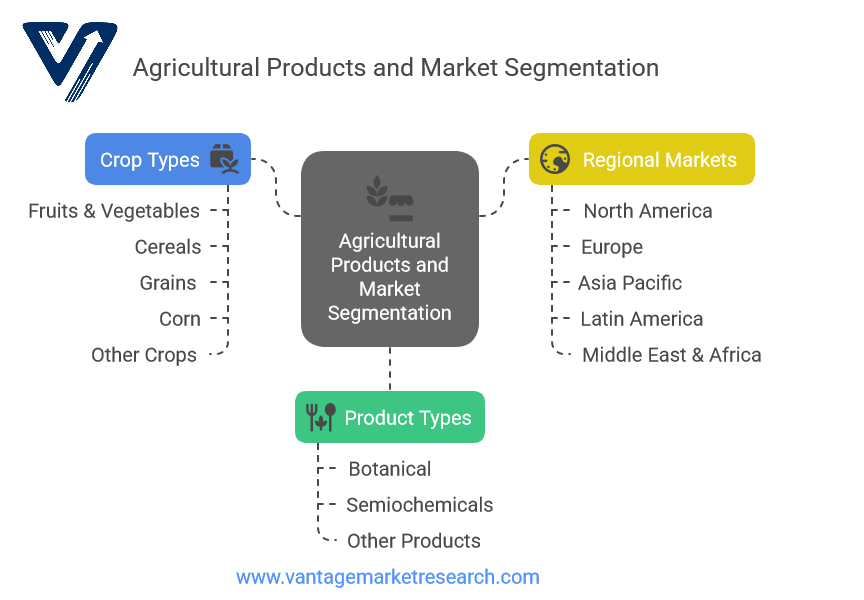

- Botanical

- Semiochemicals

- Other Products

Within the biorationals market, botanical products led the segment in 2022, accounting for the highest share of global revenues. These include insecticides and pesticides derived from plant sources such as neem, pyrethrum, and essential oils. Their popularity stems from their compatibility with organic farming practices and their ability to decompose naturally, leaving no harmful residue on produce.

Botanical biorationals are seeing elevated demand in key agricultural hubs, particularly in the Asia Pacific region, including India and China, where traditional knowledge of plant-based pest control is being commercialized and scaled. Global movements toward reduced synthetic pesticide usage reinforce their market penetration.

Other product categories include semiochemicals—naturally occurring compounds like insect pheromones that disrupt pest mating patterns and reduce infestations without harming crops or beneficial insects. Semiochemicals have proven vital in crops such as cotton, apples, and tomatoes and are increasingly integrated into precision agriculture systems.

Another category under “other products” includes microbial-based agents such as Bacillus thuringiensis (Bt) and fungal agents. These have gained traction due to their host specificity and high compatibility with IPM practices.

Innovation remains a central focus as companies explore novel plant-derived active ingredients and fermentation techniques to improve the efficacy, stability, and shelf life of biorenewables. Public-private partnerships and research collaborations enable quicker product development and regulatory approvals, widening the commercial potential of these products.

As regulations on synthetic agrochemicals continue to tighten globally and as consumer demand for pesticide-free food increases, the botanical and semiochemical product segments will likely maintain dominance and witness robust growth through 2035.

Crop Insights

- Fruits & Vegetables

- Cereals

- Grains

- Corn

- Other Crops

The fruits and vegetables segment accounted for the largest share of the bioreals market in 2022 and is expected to maintain its dominance through 2035. This is due to these crops’ high economic value and vulnerability to pests, which necessitates frequent and effective crop protection treatments.

Biorationals provide a dual advantage in this context: they offer robust protection against pests while preserving the delicate chemical balance of high-value produce, enabling better local and export marketability. Consumers increasingly demand fruits and vegetables with minimal pesticide residue, making bioreals an attractive solution.

The application of biorationals in cereal crops, grains, and corn is also growing steadily. These crops are often cultivated on a large scale and are subject to significant pest pressure, making them viable candidates for sustainable pest control practices. However, the uptake in this segment has been somewhat slower, primarily due to cost constraints and the need for high-volume, scalable solutions.

Biorationals’ role in promoting plant health also contributes to their adoption. Products that enhance disease resistance, improve pollination, and reduce germination time are particularly valued by farmers looking to increase crop yield and reduce post-harvest losses.

While challenges such as the higher cost of biorationals compared to synthetic alternatives remain, increased support from governments and NGOs advocating organic and sustainable farming practices is expected to drive usage across all crop categories in the years ahead.

Take Action Now: Secure Your Position in the Global Biorationals Industry Today – Purchase Now.

Regional Insights

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Asia Pacific emerged as the market leader in 2022, accounting for over 32% of the global revenue share. Countries such as India, China, and Vietnam are witnessing a boom in agricultural output, spurred by food security needs and population growth. In these regions, government initiatives promoting sustainable agriculture and offering bio-input subsidies catalyze the demand for biorationals.

Europe is another key region, driven by stringent regulations against chemical pesticide usage under frameworks such as the European Green Deal and Farm to Fork Strategy. Countries like Germany, France, and the Netherlands have already adopted biorationals at scale, particularly in horticulture and viticulture.

North America, particularly the U.S., is an innovation hub for biorationals, with strong private sector investment in R&D, biotechnology, and IPM-based farming. The region also benefits from consumer-driven organic and non-GMO food movements, creating a steady demand for low-residue produce.

Latin America, the Middle East, and Africa represent high-potential growth markets due to expanding agricultural exports, especially in countries like Brazil, Mexico, and South Africa. These regions are expected to play a larger role in the market as infrastructure improves and awareness of sustainable agricultural practices grows.

Competitive Landscape

The global biorationals market is characterized by intense competition and rapid innovation. Major players dominate through strategic collaborations, acquisitions, and product development aimed at expanding their global footprint and tapping into high-growth markets.

Key market participants include:

- Koppert B.V. (Netherlands)

- Bayer AG (Germany)

- Isagro S.P.A. (Italy)

- Gowan Company LLC (U.S.)

- Summit Chemical Company (U.S.)

- Suterra LLC (U.S.)

- Russell IPM (UK)

- Agralan Ltd. (UK)

- BASF SE (Germany)

- Syngenta (Switzerland)

- Monsanto (U.S.)

- Nufarm (Australia)

View the full report now for the Biorationals Market Research Report and updates!

For instance, in February 2023, Bayer expanded its digital agriculture footprint by acquiring Blackford Analysis to enhance its imaging technology, indirectly aiding precision biorational application. Similarly, Valent BioSciences expanded its operations to sell bio-stimulants directly in the U.S. market, boosting accessibility and brand recognition.

M&A activity in the sector is also rising as established agrochemical companies diversify their portfolios with bio-based solutions while startups bring agility and niche innovation into the competitive mix.

Global Biorationals Market Segmentation

By Product:

- Botanical

- Semiochemicals

- Other Products (Microbials, Fungal Agents, etc.)

By Crop:

- Fruits & Vegetables

- Cereals & Grains

- Corn

- Other Crops (Pulses, Oilseeds, etc.)

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

FAQ.

- What factors are driving the growth of the Biorationals Market?

- How does the current valuation of USD 0.9 billion for the biotionals market compare to future projections?

- What are the implications of a 9.7% CAGR for stakeholders in the Biorationals Market?

- What are Biorationals, and how do they differ from traditional agricultural products?

- What are the key applications of biorationals in agriculture?

- What challenges does the bioticals market face in its growth trajectory?

![[Market Research Reports] – Research Google News Blog | VMR.Biz](https://www.vmr.biz/wp-content/uploads/2022/12/logo-removebg-preview.png)