Injectable Drug Delivery Market Research Report (2025-2035)

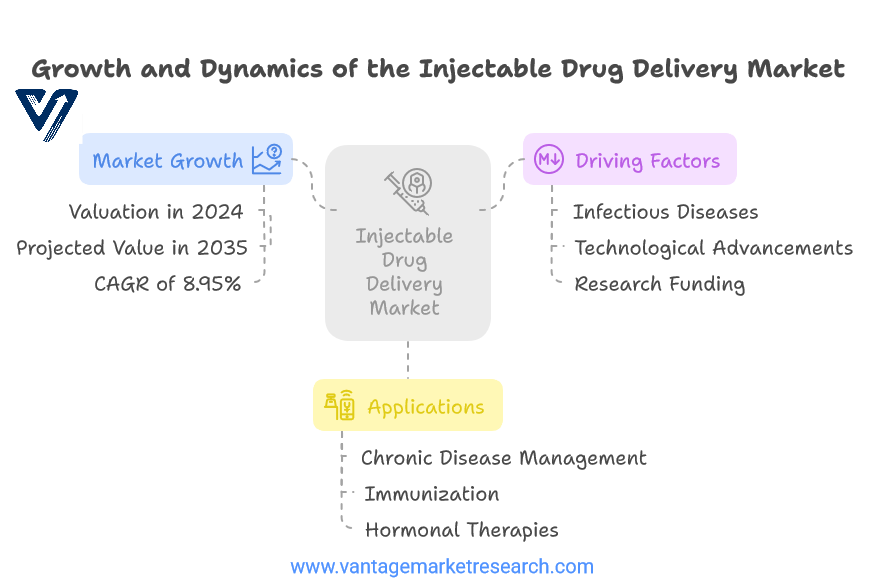

This market research report provides an in-depth analysis of the Injectable Drug Delivery Market, projecting significant growth from 2025 to 2035. The global market is expected to expand from USD 704.38 billion in 2024 to USD 1808.5 billion by 2035, with a compound annual growth rate (CAGR) of 8.95%. This report explores the dynamics driving market growth, including the increasing prevalence of infectious diseases, technological advancements, and funding for research and development. It also addresses challenges like needlestick injuries and competition from alternative drug delivery methods.

Market Size & Forecast

According to analysts at Vantage Market Research, the Global Injectable Drug Delivery Market is valued at USD 704.38 billion in 2024 and is projected to reach a value of USD 1808.5 billion by 2035 at a CAGR of 8.95% between 2025 and 2035. The growth of this market is primarily driven by the increasing prevalence of infectious diseases, advancements in technology, and enhanced funding scenarios for research and development in the injectable drug delivery sector. The market is characterized by various applications, including chronic disease management, immunization, and hormonal therapies, which further contribute to its expansion.

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.vantagemarketresearch.com/injectable-drug-delivery-market-1741/request-sample

Key Takeaways

- Market valued at USD 704.38 billion in 2024, expected to grow at a CAGR of 8.95% through 2035.

- Growth is driven by rising chronic disease prevalence (e.g., diabetes, cancer, autoimmune conditions).

- Formulations segment led with 57.9% revenue share in 2023.

- Devices segment to grow rapidly due to self-administration trends.

- Hospitals remain dominant end-users, but homecare settings show fastest growth.

- Autoimmune disorders dominate therapeutic applications.

- Oncology projected to grow fastest at 11.75% CAGR.

- Demand rising for autoinjectors, wearable injectors, needle-free injectors.

- Aging population boosts long-term injectable treatment demand.

- Government initiatives supporting chronic disease treatment with injectables.

Market Dynamics

Increased Prevalence of Chronic Diseases

Injectable drug administration is critical for treating various infectious disorders, including bacterial, viral, fungal, and parasitic infections. Many antibiotics, antiviral treatments, antifungal agents, and antiparasitic therapies are supplied intravenously to achieve quick and effective drug concentrations in the bloodstream and target tissues. Injectable drugs are widely used to treat chronic infectious diseases such as tuberculosis (TB) and HIV/AIDS. TB treatment often combines oral antibiotics with injectable treatments like rifampin, isoniazid, and streptomycin to effectively target TB germs and prevent medication resistance. Similarly, injectable antiretroviral medications are utilized in HIV/AIDS therapy regimens to inhibit viral replication and slow disease progression.

Infections Associated with Needlestick Injuries

Needlestick injuries, or percutaneous injuries, pose a significant risk as they can transmit infectious pathogens if the needle or sharp instrument comes into contact with blood or bodily fluids. Bloodborne infections such as syphilis, malaria, and human T-cell lymphotropic virus (HTLV) can result from these injuries, leading to a range of symptoms and complications. Additionally, needlestick injuries can introduce bacteria into the body, causing localized or systemic illness, with common pathogens including Staphylococcus aureus and Streptococcus species.

Increase in Demand for Biosimilars and Generic Medicine

The rising demand for biosimilars and generic injectable pharmaceuticals presents a significant opportunity for pharmaceutical companies to diversify their product portfolios in the injectable drug delivery sector. Companies can develop and manufacture injectable biosimilars and generic pharmaceuticals for various therapeutic areas, including oncology, autoimmune diseases, diabetes, and infectious diseases. These products are generally more affordable than brand-name medications, enhancing accessibility for patients, healthcare providers, and healthcare systems. Injectable drug delivery systems are crucial in administering biosimilars and generic pharmaceuticals, ensuring safe, effective, and convenient delivery options for patients undergoing long-term or chronic therapies.

Preference for Other Modes of Drug Delivery

While injectable drug delivery offers rapid systemic absorption, it also presents challenges such as needlestick injuries, needle phobia, anxiety, and pain. These factors limit the market for injectables to some extent. Among the various routes of drug delivery, the oral route is the most preferred due to its ease of use, convenience, cost-effectiveness, safety, and high patient acceptance. Inhalation methods facilitate rapid absorption, while topical administration is less invasive and more compliant for patients. This preference for alternative routes of drug administration poses a significant challenge to the injectable drug delivery technology market.

Ecosystem Insights

The Formulations segment of the Injectable drug delivery industry is expected to witness the highest growth during the forecast period. Injectable formulations cater to various therapeutic needs, including oncology, diabetes, autoimmune illnesses, cardiovascular disease, and infectious diseases. Each therapeutic category may necessitate unique formulations tailored to the drug’s properties and patient population needs, contributing to the diversity of the formulation segment. Continuous advancements in drug delivery technology enable the creation of innovative formulations with enhanced features such as sustained release, targeted distribution, and increased stability, fueling market expansion by increasing the number of injectable formulations available to healthcare practitioners and patients.

Take Action Now: Secure Your Position in the Global Injectable Drug Delivery Industry Today – Purchase Now.

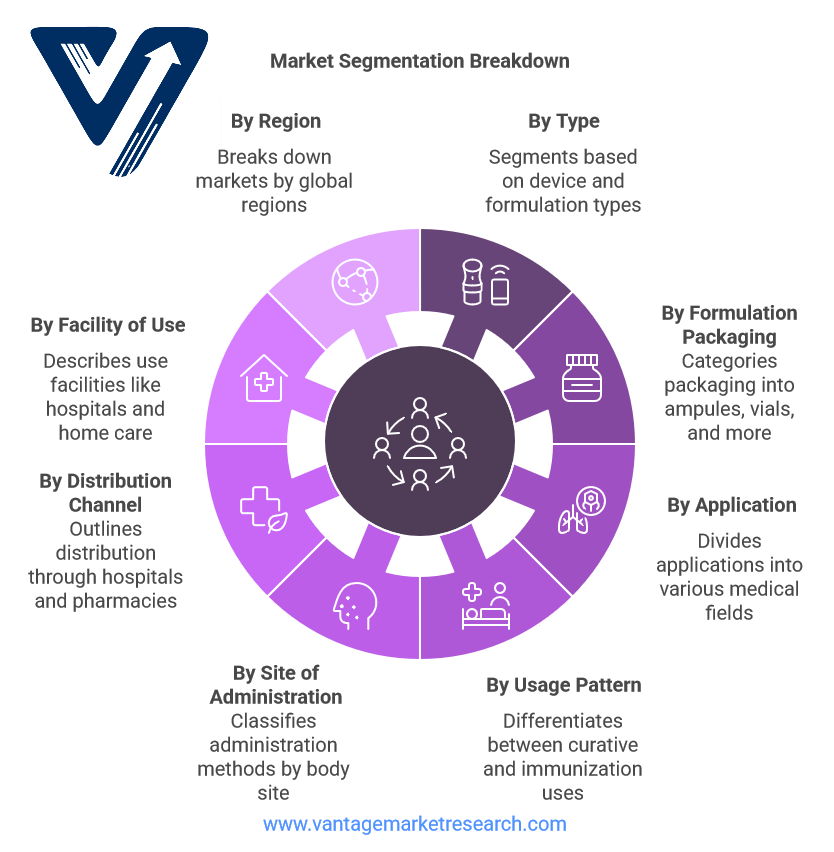

Market Segments

The injectable drug delivery market is segmented into various categories, with detailed insights into products, end-use, therapeutic areas, and regional distribution. This offers a comprehensive understanding of the market dynamics and growth trends.

- By Type: Devices, Formulations

- By Formulation Packaging: Ampules, Vials, Cartridges, Bottles

- By Application: Auto-Immune Diseases, Hormonal Disorders, Orphan Diseases, Oncology, Other Applications

- By Usage Pattern: Curative Care, Immunization, Other Patterns

- By Site of Administration: Skin, Circulatory/Musculoskeletal, Organs, Central Nervous System

- By Distribution Channel: Hospitals, Retail Pharmacy Stores

- By Facility of Use: Hospitals & Clinics, Home Care Settings, Other Facilities of Use

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Product Analysis

The market is primarily segmented into formulations and devices. In 2023, the formulations segment led the market, accounting for 57.9% of the total revenue. This dominance is driven by the rising prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and cancer, which often require long-term injectable treatments. The growing acceptance of self-injection practices among patients, coupled with the surge in demand for biologics, has further propelled the formulation segment forward. Due to their complex structure, biologics often necessitate parenteral delivery to ensure efficacy, and this demand translates into consistent market growth. Innovations in drug formulation, particularly long-acting injectables and depot injections, have further enhanced this segment by enabling more convenient dosing schedules, reducing the frequency of administration, and improving patient adherence.

Conversely, the devices segment is projected to grow the fastest, with a significant CAGR of 9.3% over the forecast period. The surge in demand for user-friendly, convenient drug delivery solutions has fueled this growth. Technological advancements in autoinjectors, wearable, and pen injectors are pivotal in enhancing the overall patient experience. These devices enable easier and safer self-administration, particularly valuable for chronic conditions requiring frequent medication. The rise in personalized medicine is also contributing to the momentum in this segment, as tailored treatment regimens necessitate advanced drug delivery technologies that are both precise and adaptable to individual patient needs.

End-use Analysis

From an end-user perspective, hospitals held the dominant market share of 53.2% in 2023. Hospitals play a critical role in the administration of injectable drugs, especially for acute and emergency care scenarios where immediate therapeutic action is essential. The adoption of advanced injectable devices within hospitals is increasing as they offer greater precision, safety, and efficiency. Automated delivery systems are increasingly integrated into hospital workflows, helping to reduce dependence on nursing staff, minimize dosing errors, and manage operational costs.

On the other hand, the homecare segment is poised to experience the fastest growth, with a projected CAGR of 9.2%. The trend toward home-based care is becoming more pronounced, driven by a growing elderly population and the need for chronic disease management outside traditional clinical settings. The development of intuitive, easy-to-use devices such as prefilled syringes and autoinjectors empowers patients to self-administer medication safely and effectively. This shift supports patient independence and alleviates pressure on healthcare systems by reducing hospital admissions and overall treatment costs.

Therapeutic Use Analysis

In terms of therapeutic application, autoimmune disorders held the largest share, 43.3%, in 2023. Diseases such as rheumatoid arthritis, lupus, and multiple sclerosis require consistent, long-term medication regimens, many of which involve injectable biologics. Injectable drug delivery solutions, especially those allowing self-administration, have significantly improved the quality of life for patients managing these conditions. They offer enhanced convenience and adherence, critical to effective disease control.

Meanwhile, oncology is expected to witness the highest CAGR of 9.3% during the forecast period. The rising global incidence of cancer, coupled with the ongoing development of targeted biologics and immunotherapies, is a key growth driver. Due to their molecular complexity and need for controlled administration, injectable formats remain essential for delivering many of these advanced therapies. As cancer treatment becomes increasingly personalized and sophisticated, injectable drug delivery systems are expected to play an even more central role.

Regional Analysis

Regionally, North America led the injectable drug delivery devices market in 2023, capturing 40.5% of the market share. This dominance is attributed to the high prevalence of chronic diseases, robust healthcare infrastructure, and widespread use of self-injection devices. In particular, the U.S. has shown strong adoption of advanced drug delivery systems, supported by ongoing technological innovation and growing awareness among patients and healthcare providers.

Europe followed closely, with aging populations contributing to increased demand for injectable treatments. The region’s focus on managing chronic diseases and expanding personalized healthcare options, such as the approval of weight-management injectable drugs by the UK’s Medicines and Healthcare Products Regulatory Agency, underscores the growing reliance on injectable solutions. Countries like the UK are making notable progress, with rising healthcare expenditure and a focus on modern, patient-centric care models.

Asia Pacific is projected to be the fastest-growing region over the forecast period, fueled by expanding healthcare infrastructure, rising disposable income, and an increasing burden of chronic diseases. In countries like India, launching innovative products such as Sanofi’s Soliqua for type 2 diabetes and obesity marks a growing trend toward addressing regional healthcare needs through injectable therapies. This growth is further supported by adopting advanced medical technologies and government efforts to improve healthcare accessibility across urban and rural areas.

The injectable drug delivery market is poised for continued expansion, with strong contributions from advancements in drug formulations and delivery devices, increasing demand for self-care solutions, and a global shift toward personalized and chronic disease management.

For the Injectable Drug Delivery Market Research Report and updates, view the full report now!

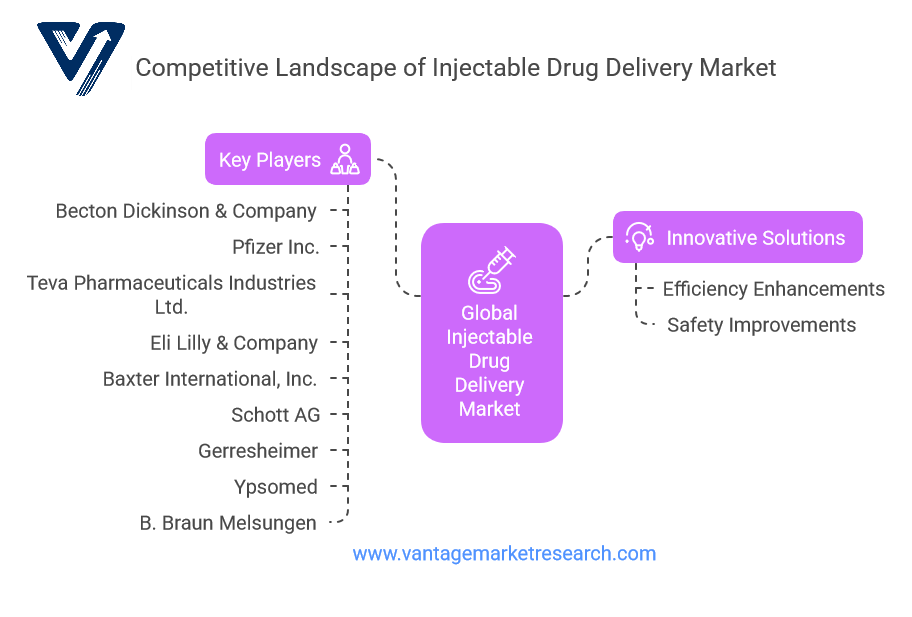

Competitive Landscape

Key players in the Global Injectable Drug Delivery Market include Becton Dickinson & Company (U.S.), Pfizer Inc. (U.S.), Teva Pharmaceuticals Industries Ltd. (Israel), Eli Lilly & Company (U.S.), Baxter International, Inc. (U.S.), Schott AG (Germany), Gerresheimer (Germany), Ypsomed (Switzerland), B. Braun Melsungen (Germany), and others. These companies are actively involved in developing innovative solutions to enhance the efficiency and safety of injectable drug delivery systems.

Recent Developments in the Injectable Drug Delivery Market

The market is witnessing continuous innovations and developments, with companies focusing on enhancing the safety and efficacy of injectable drug delivery systems. Recent advancements include introducing smart delivery devices, novel formulations, and improved packaging solutions to reduce the risks associated with needlestick injuries and enhance patient compliance. Additionally, collaborations and partnerships among key players are expected to drive further growth and innovation in the injectable drug delivery market over the coming years.

The injectable drug delivery market continues to evolve rapidly, driven by innovation in drug formulation, delivery device compatibility, and strategic expansions by key pharmaceutical companies. Recent developments in 2023 and 2024 highlight a growing emphasis on patient-centric solutions, enhanced manufacturing capabilities, and expansion into underserved therapeutic areas.

In July 2024, Schott AG, a global leader in pharmaceutical packaging, introduced 10ml ready-to-use cartridges tailored for injectable medications targeting various diseases, including cancer, genetic disorders, metabolic disorders, cardiovascular conditions, and immunological diseases. These cartridges are designed to be compatible with Ypsomed’s YpsoDose—a large-volume, pre-filled, pre-loaded injector system intended for self-administration. This innovation supports the industry’s move toward enabling patients to manage their treatments from the comfort of their homes, thus reducing hospital visits and enhancing treatment adherence. The combination of Schott’s advanced cartridge technology and Ypsomed’s user-friendly device platform aims to simplify the delivery of complex biologics, supporting the growing demand for personalized and at-home care.

In April 2024, Baxter International Inc., a global healthcare company known for its expertise in critical care and hospital products, expanded its injectable portfolio in the United States by launching five new injectable medications. These include pre-filled syringes and ready-to-use intravenous (IV) solutions, designed to address unmet clinical needs, particularly in anti-infective and anti-hypotensive therapies. Introducing ready-to-use formats improves administration efficiency and safety by reducing compounding errors and saving preparation time in emergency and inpatient settings. Baxter’s expansion underscores the growing importance of providing clinicians with convenient, sterile injectable options, especially in acute care environments.

Also in April 2024, Eli Lilly and Company strategically expanded its injectable drug manufacturing capabilities by acquiring a production facility from Nexus Pharmaceuticals. The facility in Wisconsin is FDA-approved and will significantly bolster Lilly’s ability to meet the rising demand for its portfolio of injectable medications. With the increasing adoption of biologics and specialized injectables in therapeutic areas such as diabetes, oncology, and immunology, the acquisition enhances Lilly’s vertical integration and supply chain efficiency. This move supports the company’s growth in the injectable segment and reinforces its commitment to improving access and production scalability in the United States.

In March 2023, Sanofi launched Soliqua in the Indian market, a once-daily injectable treatment for type 2 diabetes and obesity. Packaged in pre-filled pens with two dosing options, Soliqua is a combination therapy that merges insulin glargine with lixisenatide, aimed at patients whose blood sugar levels are inadequately controlled through lifestyle interventions or oral medications alone. This launch represents a strategic effort by Sanofi to penetrate the growing diabetes market in India, which is witnessing a sharp rise in obesity and lifestyle-related chronic conditions. Soliqua’s convenient delivery format and dual-action mechanism align with the broader industry trend of offering simplified combination therapies that support long-term disease management.

Collectively, these developments emphasize the market’s commitment to improving drug delivery efficiency, enhancing patient experience, and expanding therapeutic coverage. The focus on ready-to-use formats, self-administration, and manufacturing scale-up illustrates how pharmaceutical and device companies adapt to a healthcare landscape that increasingly values home-based care, personalized medicine, and operational sustainability. As more innovations emerge in formulation science, delivery technologies, and regulatory support, the injectable drug delivery market is poised for substantial growth in the coming years.

FAQ.

- What is driving the rapid growth of the injectable drug delivery market globally?

- How are self-administration devices impacting patient adherence and healthcare delivery?

- What role do biologics and biosimilars play in the injectable drug delivery landscape?

- Which device types (e.g., autoinjectors, wearable injectors) are gaining the most traction?

- How are regulations affecting the development and approval of injectable delivery systems?

- What regions are experiencing the fastest market growth, and why?

- How is the rise of home healthcare influencing injectable drug delivery innovation?

- What are the major challenges in manufacturing and distributing injectable drugs?

- How is AI and digital health integration transforming injectable device functionality?

- Which companies are leading the market, and what strategies are they using?

![[Market Research Reports] – Research Google News Blog | VMR.Biz](https://www.vmr.biz/wp-content/uploads/2022/12/logo-removebg-preview.png)